- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

DON'T DELAY! IRS deadline to file & avoid penalties was April 15. We can help! Find a location.

FILE FAST & EASY

File in-person with an expert Tax Pro

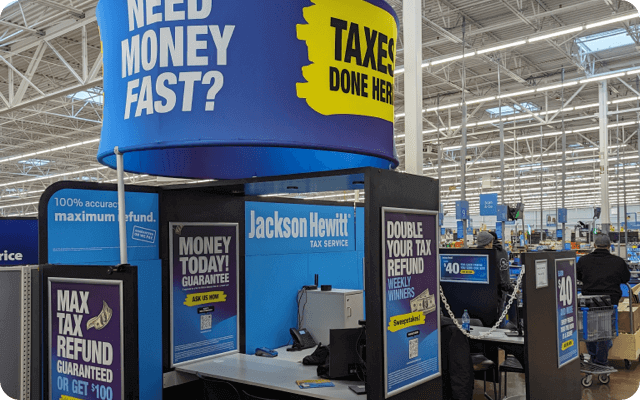

Need expert tax services near you? Come to Jackson Hewitt for the best local tax preparation. Backed by a 40+ year national company, Tax Pros are in your community, including inside many Walmart stores, and are ready to help you get your biggest refund, guaranteed, and more.

TRUSTED. CONVENIENT. EXPERTISE. YES!

5 reasons to trust Jackson Hewitt Tax Services

Expect the best tax preparation experience, year after year.

-

Your biggest refund, guaranteed, or your money back plus $100.

-

Friendly, local Tax Pros do the hard part. You rest easy.

-

We sign your return, too, and guarantee it’s right for life.

-

Over 40 years of experience. Over 65 million returns.

-

Over 5,200 locations open evenings and weekends.

Get the tax services you need & file in-person today

-

Individual income tax preparation

-

Simple tax return

-

Self-employment taxes

-

Cryptocurrency taxes

-

File a tax extension

-

File an amended tax return

3 easy ways to file taxes with a Tax Pro

File at Jackson Hewitt

We’re in your neighborhood with over 5,200 national locations. Meet your local Tax Pro today.

File in Walmart

We’re also in over 2,600 Walmart stores across the nation. File while you shop! Convenient & secure.

Drop off & go

Simply leave your tax docs with your local Tax Pro near you or in Walmart. No need to return!

What to bring when you file

A handy checklist of tax documents you’ll need to file your return and get your biggest refund.

- W-2/1099 and any other income docs

- Government-issued ID

- Health Insurance Marketplace Form 1095-A

Get your personalized document checklist

IT’S WRITTEN IN THE STARS

Find out why our clients trust us

most, year after year

4.8 out of 5 star rating

(233,809 customer reviews)

*Actual customer testimonials. Sweepstakes entry offered. Photos are illustrative only.

FAQs about filing in-person

Find a location near you

We’re in your neighborhood with over 5,200 locations and inside more than 2,600 Walmart stores.

Maximum Refund Guarantee (Biggest Refund Guarantee) - FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we'll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.

Biggest Refund Guarantee

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

Lifetime Accuracy Guarantee

If there is an error preparing your return resulting in an increased tax liability, the local office that prepared your return will reimburse you for penalties and interest (but not additional taxes) owed. You must notify us within 30 days of receiving initial notice from a taxing authority and provide necessary documents and/or assistance. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

PROOF OF PRIOR YEAR PAYMENT REQUIRED WHEN FILING

Valid only at participating locations 2/12-4/7/24 for new clients (did not file prior year tax return with JH) filing an eligible return. Discount based on 2023 tax prep fees (2022 tax year returns). Excludes prior year amendments, $0 tax prep, and filings without a federal tax return. Offer valid on tax preparation fees only and on no other product or service. Not valid with any other promotion or discount. Not applicable for Jackson Hewitt Online. Must provide promo Code EZF2G when starting tax prep. Offer may be modified or discontinued at any time. Most offices are independently owned and operated.

NO PURCHASE NECESSARY TO ENTER OR WIN. Purchasing does not improve your chances of winning. The Double Your Refund Sweepstakes is open to legal residents of the 50 United States, including the District of Columbia, age 18 or older at the time of entry and who have filed their federal tax return within the promotion period (1/2/24 - 4/15/24). The Sweepstakes consists of 15 weekly drawings beginning on 1/18/2024 and one (1) Additional Drawing at the conclusion of the last weekly drawing period. Grand Prizes (refund match amounts) are capped at $10,000 per winner. Grand prize winners will receive a minimum of $1,500. Filing your taxes with Jackson Hewitt automatically enters you in the weekly sweepstakes drawing applicable to the period during which you filed your return, as well as the Additional Drawing. Odds of winning depend on the number of eligible entrants per each drawing period and overall entries for the Additional Drawing. For full Official Rules containing alternate methods of entry, weekly drawing periods, prize details, other eligibility requirements, and restrictions, visit www.jacksonhewitt.com/sweepstakes. Sponsor: Jackson Hewitt Inc., 10 Exchange Place, 27th Floor, Jersey City, NJ 07302

Ratings from Google Reviews, via Medallia, as of 10/26/23.

Biggest Refund Guarantee

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.