- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

EXPERT HELP IS HERE

File an amended tax return

Don’t take chances with your refund. If you need to amend your tax return(s) due to an error or missed credit, don’t worry! Your local Tax Pro can do a free recheck for accuracy, help you file an IRS amended return, and track your amended tax return status, too.

How to amend a tax return

-

1

Book an appointment

We have over 5,200 locations nationally, including inside more than 2,600 Walmart stores.

-

2

We’ll do a recheck

Bring your tax return to your Tax Pro. We'll file an accurate, 1040-X amended tax return for you.

-

3

You get to relax!

You don’t have to wonder, “where’s my amended return?” Get status updates using your MyJH account.

Find a location

HAVE NO FEAR. YOUR EXPERT IS HERE.

Confidence in your amended tax return

Taxes can be stressful. Especially after you’ve filed on time, but then need an IRS amended return. You’re not alone and we’re here to help! Meet with an expert Tax Pro who can help you file an amended tax return and fast. Let’s ensure you’re getting back every dollar you deserve. We guarantee your max refund and 100% accuracy, too. Stop by your nearest Jackson Hewitt today or call us any time.

WE MAKE IT EASY

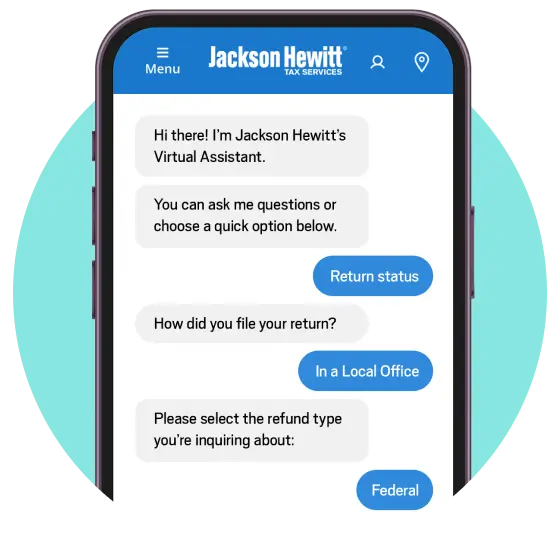

How to check amended tax return status

When you file an amendment with Jackson Hewitt’s help, you can track your IRS amended return status online. Easy peasy.

- Create a new, or log into your existing MyJH account to learn the status of your return.

- Using our Live Chat, you’ll be asked the year and filing status of the amended return, and primary filer’s birthdate and SS number.

- You can also click the “Track my return status” feature to learn more.

When to file an amended tax return

Not sure when to amend? Here are a few common situations for taxpayers that are typical to filing an amended return.

-

Missed credits or deductions

Didn’t claim the Child & Dependent Care Tax Credit, or other deductions you qualify for? File an amendment and get back every dollar you deserve.

-

Your filing status is incorrect

If you accidentally chose the wrong filing status, you’ll need to amend your tax return to correct it. An expert Tax Pro can help you amend and ensure your biggest refund.

-

Missing taxable income

Forgot to include taxable income on your return? Don’t worry, we can help you file an amendment so that you can avoid an IRS audit or penalties.

-

Add or remove a dependent

Every dollar matters. If you have dependents or need to drop any, filing an amendment is your best course to action to take to ensure your max refund.

Find a location

TAX TIPS

More reasons to file an amended tax return

Our resident Taxpert, Mark Steber, explains what you need to know about filing an IRS amended return.

Frequently asked questions

Related articles

A Guide to Amending Tax Returns

Tax return mistakes happen more often than you might think. It’s typically not a big deal, because most mistakes can be fixed by filing an amended tax return. Don’t miss this video where Mark Steber shares everything you need to know about how amending a tax return can not only fix mistakes, but could get you more money in your pocket.

Tax extension deadlines & penalties

We know life gets complicated. If you weren’t able to file your taxes by the deadline, here’s what you need to know about filing extensions, what the penalties and fees are for failure to file and failure to pay, and how you can get yourself back on track.

More Results

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.

Biggest Refund Guarantee

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

Lifetime Accuracy Guarantee

If there is an error preparing your return resulting in an increased tax liability, the local office that prepared your return will reimburse you for penalties and interest (but not additional taxes) owed. You must notify us within 30 days of receiving initial notice from a taxing authority and provide necessary documents and/or assistance. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.