- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

EARLY TO FILE. EARLY TO SMILE.

Filing your taxes early. Key dates & benefits for 2025.

Filing your 2024 taxes early in 2025 can mean getting your refund as soon as possible while avoiding long lines and late penalties. But there are even more great reasons to file early. Tax Pros are here to help!

Stay ahead of Tax Day, April 15, 2025

This is the final date your taxes are due, unless you’ve filed an extension before this date. But there are many benefits to filing early, well before the April deadline and as soon as the IRS begins accepting tax returns in January.

Better protection against ID theft & fraud

Filing taxes early can help protect you and your family against identity theft and fraud, by locking down your personal info sooner.

Get your tax refund sooner

Filing taxes early can mean a faster process time by the IRS, which means your tax refund could arrive sooner than if you’d waited until the last day to file.

More time for payment & organization

If you owe the IRS tax money, filing early gives you more time to prepare your payment or choose a payment plan, before it’s due on April 15.

3 easy ways to file taxes with a Tax Pro

File at Jackson Hewitt

We’re in your neighborhood with over 5,200 national locations. Meet your local Tax Pro today.

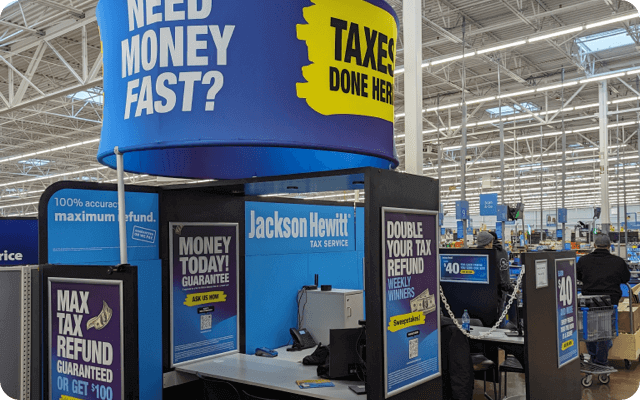

File in Walmart

We’re also in over 2,600 Walmart stores across the nation. File while you shop! Convenient & secure.

Drop off & go

Simply leave your tax docs with your local Tax Pro near you or in Walmart. No need to return!

5 reasons to switch to Jackson Hewitt

Expect the best tax preparation experience. This year and every year.

-

Your biggest refund, guaranteed, or your money back plus $100.

-

Friendly, local Tax Pros do the hard part. You rest easy.

-

We sign your return, too, and guarantee it’s right for life.

-

Over 40 years of experience. Over 65 million returns.

-

Over 5,200 locations open evenings and weekends.

IT’S WRITTEN IN THE STARS

Find out why our clients trust us

most, year after year

4.8 out of 5 star rating

(233,809 customer reviews)

*Actual customer testimonials. Sweepstakes entry offered.

Photos are illustrative only.

Ratings from Google Reviews, via Medallia, as of 10/26/23.

Biggest Refund Guarantee

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

Lifetime Accuracy Guarantee

If there is an error preparing your return resulting in an increased tax liability, the local office that prepared your return will reimburse you for penalties and interest (but not additional taxes) owed. You must notify us within 30 days of receiving initial notice from a taxing authority and provide necessary documents and/or assistance. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.