- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS resources

Our guides break down complex IRS topics. Learn more about tax forms, IRS notices and letters, and tax scams.

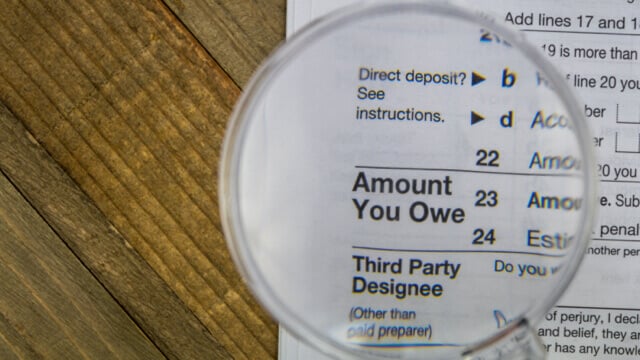

IRS tax forms

What You Need to Know About 1040 Tax Return Forms

A 1040 tax form is the main form for a tax return that gets filed with the IRS when you are a US citizen or resident with taxable income to report.

-4 Form Changes: What You Need to Know for 2023

Starting a new job and going through other major life events often mean that you’ll have to think about filling out or revising your withholdings. In 2020, the IRS made significant changes to Form W-4 to help individuals withhold federal income tax more accurately from their paychecks. Read on to learn when what the major changes are, and how paying the right amount in taxes as you go could be the difference between a tax refund or a tax bill when you file your federal and state returns.

More Results

IRS audits and notices

Featured

7 common IRS notices: what you need to know

I received an IRS notice - now what? If you don’t read the notice you received, you may miss an easy resolution opportunity, important deadlines, or accrue additional penalties and interest on outstanding tax debts. Follow these essential steps to respond to an IRS letter.

What is IRS Notice CP14?

Getting any notice from the IRS can cause confusion and stress. It’s good that a CP14 notice is intended to be more informational, and less scary, for taxpayers just like you. So, don’t panic, and allow us to better explain what these unfamiliar tax terms are, and how it can affect your taxes. Keep reading to understand what your CP14 notice means.

What is IRS Notice CP11?

IRS notices are letters sent to inform taxpayers of important tax information. Each one is different, but we can explain what the CP11 is about.

What is the IRS Letter 5071C?

With identity theft, data breaches, and tax scams (read our article about those here) becoming more and more common, protecting your personal information should be a top priority. Thankfully, the IRS thinks so too.

More Results

Audits

How do you know if you're being audited by the IRS?

While the risk of being audited is quite low for most, being aware of what audits are, why they are conducted, and how to know that you are being audited is essential for every taxpayer.

How long does it take to resolve an IRS audit?

IRS audits are rare. But if you are subject to an audit, how long does it take to resolve?

TAX FILE MINUTE: ANSWERS FROM A TAX INSIDER

Why does the IRS send a tax notice and what to do

IRS fraud and tax scams

What Happens If You Lie On Your Taxes?

It is a federal crime to commit tax fraud and you can be fined substantial penalties and face jail time. Lying on your tax return means you committed tax fraud.

Tax Avoidance Vs Tax Evasion: What’s The Difference?

Tax evasion can lead to fines and criminal charges while using the tax laws to minimize your taxes is often encouraged. So, what's the difference between them?

More Results

Related content and resources

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.