- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Where's My Refund

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call 941-208-6378 today.

IRS AUDITS & TAX NOTICES

What are the Chances of an IRS Audit?

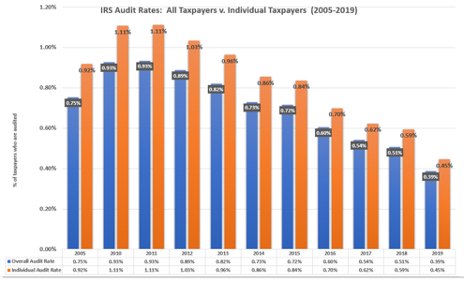

Since 2010, the number of IRS audits has dropped by nearly half, as the audit rate slipped from 0.93% to 0.39% in 2019.

The IRS audit rate dipped to 0.2% in 2020 due to COVID-19. However, 2020 audit rates are not normal for the IRS.

However, despite a significant reduction in overall audits, some taxpayer profiles didn’t experience the same dropoff in audits as other segments. The most glaring example is lower income taxpayers who rely on the Earned Income Tax Credit (EITC). Since 2010, the number of EITC audits has dropped. However, the percentage of EITC audits comparable to other audits has increased.

In 2019, of the 771,095 total individual audits conducted, 301,108 (44% of the total) involved a taxpayer claiming the Earned Income Tax Credit. Compare that rate to 2010 when the IRS had more resources. In 2010, the IRS conducted 585,202 of the 1,581,394 total individual audits (37%) of its audits on EITC profiled taxpayers. Compare this percentage increase to audits of high-wealth individual taxpayers (income >$1 million) and non-EITC small business individual taxpayers like sole proprietors that don’t claim the EITC. Audits of high-wealth and small business audits have generally stayed flat over the same time period.

High-wealth individual taxpayer audits as a percentage of total audits have oscillated over the years, settling around 2% of all individual audits. The IRS audited 32,494 taxpayers with income greater than $1 million in 2010, representing 2% of all individual audits. In 2019, high wealth audits declined to 13,946, still representing 2% of all audits.

Unlike EITC audits, small business audits did not increase greatly as a percentage of overall IRS individual audits during these lean audit periods. In 2010, 282,866 small business individual taxpayers experienced an audit. This accounted for 18% of all individual audits. In 2019, IRS audits of small businesses increased slightly compared to 2010: 22% of all individual audits.

Small business audits are critical to the IRS given they have the highest degree of noncompliance. The IRS must use more sophisticated audit resources to validate these returns because small business tax compliance heavily relies on taxpayers voluntarily reporting income and expenses. In the latest IRS tax gap study, small business taxpayers had a misreporting rate of 56%, much higher than wage earning taxpayers (those who receive a Form W-2) who had a misreporting rate of only 1%.

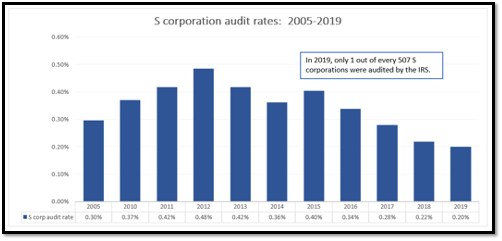

Only 1 out of 507 small business S corporations currently get audited

The individual audit rate for small businesses appears unchanged since 2010. However, that statistic does not account for the entire small business population. Individual small business audit numbers are only one segment of the small business population. Many small businesses incorporate and elect S corporation status. In essence, many small businesses create separate entities for tax purposes, but their business size and operations closely mirror sole proprietorship individual taxpayers.

The S corporation status has traditionally been popular too. The number of small businesses electing S corporation status has increased substantially since 2010. In 2010, there were 4.4 million S corporations. By 2019, S corporations had grown 10% to 5.1 million.

However, these small business entities continue to see low audit rates, and they have decreased since IRS audit resources diminished. Since 2010, S corp audits dropped by 46% (from an already low audit rate of 0.37%) to an almost non-existent audit rate of 0.2% in 2019. By 2019, just over 10,000 S corporations were examined by the IRS. This illustrates that the S corporation audit is a primary audit casualty when IRS audit resources are scarce.

Is the IRS picking on low-income taxpayers?

Audit resources at the IRS are still scarce. So why do they focus more on low-income taxpayers when audit resources are diminishing?

Low-income taxpayers are perhaps the easiest and cheapest to audit. Most of their audits are done by mail and central IRS campus operations that cut down auditing costs.

There are other reasons for this audit activity. The IRS must rely on audits when they detect EITC fraud in order to hold back the refund from the taxpayer. In essence, their hands are tied.

In addition, EITC audits are generally conducted by mail versus high-wealth and small business, which largely require more face-to-face interactions to examine those returns. In 2019 (pre-COVID IRS operations), 94% of all taxpayers who claimed the EITC and were audited, were done by mail audits by the IRS. Other taxpayer segments required more expensive IRS field examinations and experienced much less audit rates by mail.

|

Taxpayer Segment |

% of audits by mail, 2019 |

|

Taxpayers with EITC claimed |

94% |

|

Individual Income > $1M |

28% |

|

Small business individuals |

67% |

|

S corporations |

5% |

Unlike other taxpayer segments, EITC audits did not drop off during lean times at the IRS because many are done cheaply through mail audits

Do you have additional questions?

For assistance creating a strategy to address your tax issue, visit Jackson Hewitt’s Tax Resolution Hub to see the various ways we can help you.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.