- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

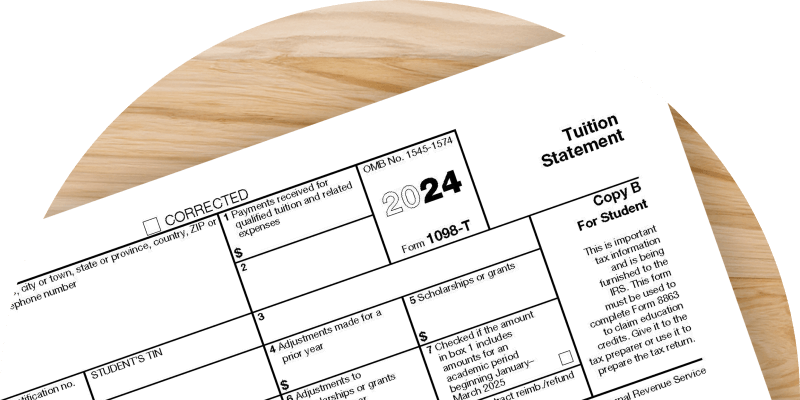

IRS FORMS: FORM 1098-T

Things college students should know about Form 1098-T

Did you know that tuition payments can help reduce your tax? Learn everything you need to know about IRS Form 1098-T, including how to report qualifying education expenses, what the different boxes mean, and more.

Key takeaways

- IRS Form 1098-T, Tuition Statement, shows how much you, your family, or others on your behalf have paid in tuition and related expenses over the past year.

- Colleges and universities are responsible for issuing Form 1098-T.

- You’ll need Form 1098-T to claim the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

- Box 1 shows the total amount of payments you made for qualified tuition and related expenses during the tax year.

- Box 2 is not currently used.

- Box 3 is not currently used.

- If your school issued a refund or there was an error in the previous year’s tuition reporting, they will report these adjustments in Box 4.

- Box 5 reports the total amount of scholarships or grants you received during the tax year.

- If you received additional scholarships or grants or had some taken back, you can find these adjustments in Box 6.

- Your school will check Box 7 if you’ve made payments for the first three months of the next year.

- Box 8 indicates whether you were enrolled at least half-time during the academic period.

- If you were a graduate student during the academic period, your school will check Box 9.

- Have you been reimbursed or refunded because you had to withdraw due to a family emergency or medical reasons? If so, your school will list the total amount in Box 10.

What is Form 1098-T used for?

IRS Form 1098-T shows how much you paid in tuition and related expenses over the past year. You’ll need it to claim education-related tax benefits when you file your taxes.

The main goal of Form 1098-T is to make sure you have a record of your educational expenses. These expenses might make you eligible for tax credits, like the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC). These credits can reduce your tax or potentially even increase your refund.

Who can take advantage of these tax credits? Either the parent or the eligible student can claim an education credit for the student’s education expenses, but not both. If a parent claims the student as their dependent, they can treat any expenses paid by the student as if the parent paid them.

What if someone other than a parent or their dependent, such as a relative, pays education expenses? In this case, the student is treated as if they are paying these expenses. If the parent claims this student as a dependent, the parent is considered to have paid these expenses.

Who issues a 1098-T?

Colleges and universities are responsible for issuing Form 1098-T. Your school's financial aid office will track your tuition payments, scholarships, and grants throughout the year. By January 31, they will send out Form 1098-T to all eligible students, either by mail or electronically.

If you haven't received your 1098-T by early February, it's a good idea to check with your school. Make sure they have your correct mailing address or email. You can usually find more information on your school’s financial aid website or by contacting their financial aid office directly.

How can a 1098-T affect your taxes?

You’ll need Form 1098-T to claim the AOTC and the LLC.

American Opportunity Tax Credit (AOTC)

The AOTC is for students in their first four years of higher education. It allows you to claim up to $2,500 per eligible student. The AOTC is partially refundable, which means even if you owe no tax, you could get up to $1,000 back as a refund.

Lifetime Learning Credits (LLC)

The LLC is for any postsecondary education and does not have a limit on the number of years you can claim it. The LLC allows you to claim up to $2,000 per tax return (not per student) but is not refundable. That means that it can lower your tax to $0 but you won’t get anything left over back in a refund.

To take advantage of these credits, you need the information from your 1098-T form. The form shows the amount you paid in tuition and related expenses, which you will use to determine your eligibility and calculate your credit.

Reporting qualifying education expenses

When you receive Form 1098-T, it’s essential to know which education expenses you can report to claim tax credits. The IRS allows you to count certain expenses towards the AOTC or the LLC.

Eligible education expenses:

- Tuition and fees required to attend classes at a college or university.

- Required materials that are necessary for your courses, like books. Any items needed for enrollment or attendance, such as activity fees, count as qualifying expenses.

- Computers, software, and other technology necessary for your coursework.

Ineligible education expenses:

- Costs for housing and meals.

- Transportation expenses for getting to and from school.

- Health or other types of insurance required by the school.

- Personal expenses, like parking fees, extracurricular activities, and non-required supplies.

When you prepare your taxes, make sure to only include the eligible expenses from the lists above. Use the amounts shown in Box 1 of your Form 1098-T as a starting point and keep track of any additional qualifying expenses.

1098-T boxes explained

Form 1098-T contains several boxes with specific information about your educational expenses and financial aid. Understanding what each box represents will help you accurately report your expenses and claim the correct education tax credits. Here’s a breakdown of each box.

1098-T Box 1

Box 1 shows the total amount of payments you made for qualified tuition and related expenses during the tax year. This includes tuition, fees, and other necessary expenses you’ve paid to the institution. Use Box 1 to determine the education expenses you can report for tax credits.

1098-T Box 2

This box is not currently used. Previously, schools reported the amounts they’ve billed for eligible tuition and related education expenses in Box 2. However, the IRS now requires schools to report the payments they’ve received (see Box 1) instead of the amounts they’ve billed.

1098-T Box 3

Box 3 is not currently used. It used to indicate if your school changed its reporting method for tuition and related expenses from the previous year.

1098-T Box 4

If your school issued a refund or there was an error in the previous year’s tuition reporting, your school will report the adjustments in Box 4. These adjustments matter because they could affect your tax credits for the previous year.

1098-T Box 5

Box 5 reports the total amount of scholarships or grants you received during the tax year. These amounts can reduce the amount of qualified expenses you can claim for tax credits. Subtract the amount in Box 5 from the amount in Box 1 to determine your net eligible expenses.

1098-T Box 6

If you received additional scholarships or grants or had some taken back, you can find these adjustments in Box 6. These changes can affect the tax credits claimed in the prior year.

1098-T Box 7

If you’ve made payments for the first three months of the next year, your school will check Box 7. This is important for determining which tax year your expenses apply to and ensuring you claim the correct amount on your taxes.

1098-T Box 8

Box 8 indicates whether you were enrolled at least half-time during the academic period, which is a requirement for claiming the AOTC.

1098-T Box 9

If you were a graduate student during the academic period, your school will check Box 9. This box helps you determine which credits you can claim. Graduate students are generally eligible for the LLC but not the AOTC.

1098-T Box 10

If you’ve been reimbursed or refunded because you had to withdraw due to a family emergency or medical reasons, your school will list the total amount in Box 10. These amounts reduce the qualified education expenses you claim.

Navigating Form 1098-T can be challenging. If you have questions or need assistance, consider working with a Jackson Hewitt Tax Pro.

Our Tax Pros can provide personalized guidance and ensure you’re claiming all the credits you’re eligible for, maximizing your savings and simplifying the tax filing process.

Read more articles from Jackson Hewitt

Get a Tax Pro

Our Tax Pros are ready to help you year-round. Find an office near you!

TAXES ARE LATE!

IRS deadline to file & avoid penalties was April 15. We can help! Find a location.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 60+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.