- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Where's My Refund

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call (855) 580-9375 today.

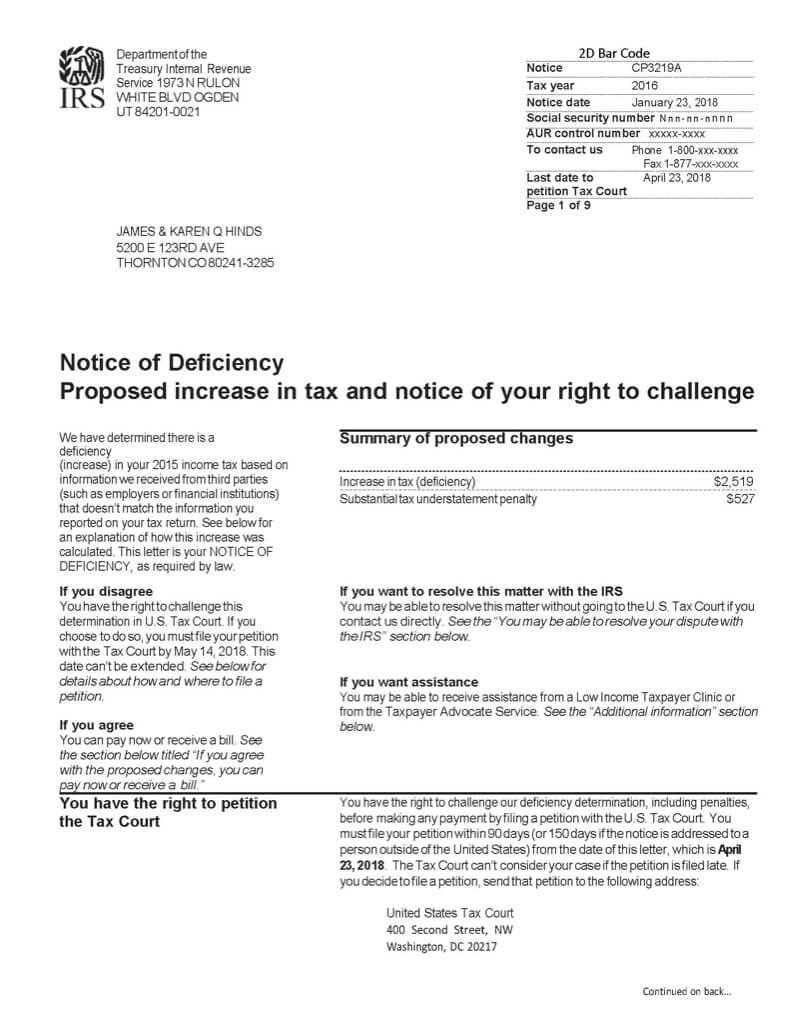

IRS NOTICES: TAX RETURN ERROR

What is a CP3219A notice?

IRS notices are letters sent to inform taxpayers of important tax information. Each one is different, but we can explain what the CP3219A is about.

Understanding your CP3219A notice

The IRS received information that is different than your tax return. The change may result in a decrease or increase in tax. The notice explains how the tax amount was calculated. If you disagree, you can challenge this in U.S. Tax Court.

Type of Notice

Tax return mistake

H2 Why you received the CP3219A notice

You received a CP3219a notice because the IRS has information that differs from what you reported on your tax return. That information has led the IRS to change the amount of income tax on your return. You have received one or more notices from the IRS asking for verification of income, credits or deductions on your return, and you did not respond.

Likely next steps

As always, read the notice carefully. Your notice will outline the increase or decrease in your tax based on the information the IRS received from a third party, like your bank or employer, after you filed your return..

If you agree with the IRS assessment, you will need to sign the enclosed Form 5564, Notice of Deficiency - Waiver, and mail to the address shown on the CP3219a notice and the IRS will then send you a bill for the amount owed.

If you disagree with the IRS assessment, according to the IRS, “…you have the right to challenge the proposed changes by filing a petition with the U.S. Tax Court no later than the date shown on the notice.”

You can also contact a tax professional to learn more about your options.

CP3219 Notice deadline

The deadline for this notice is 90 days if you want to file a petition with the U.S. Tax Court.

If you miss the deadline

If you do not file a petition with the U.S. Tax Court by the 90-day deadline, you will be subject to the IRS assessment of tax, penalties, and interest. The IRS will send you a bill for the remaining tax owed.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.