- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

PERSONAL FINANCE

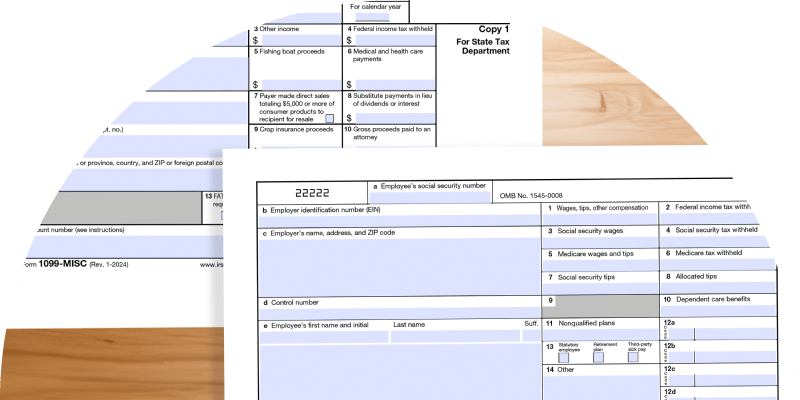

1099 vs. W-2: Is it better to be paid 1099 or W-2?

Curious about whether it’s better to be paid as a 1099 contractor or a W-2 employee? Knowing the differences can greatly influence your finances, benefits, and work-life balance. In this article, we’ll break down the pros and cons of each, cover tax implications, and provide insights to help you make the right choice for your career.

Key takeaways

- Whether you’re a 1099 independent contractor or a W-2 employee significantly affects your finances, benefits, and work-life balance.

- As a 1099 contractor, you are self-employed, set your own hours, choose your projects, and handle your own taxes and benefits.

- As a W-2 employee, your employer withholds taxes, handles tax reporting, and provides benefits, like health insurance, retirement plans, and paid leave.

- Advantages of being a 1099 contractor include greater flexibility over your projects and schedule, the potential for higher earnings through multiple clients, and the ability to deduct your business expenses from your taxable income.

- Disadvantages of being a 1099 contractor include a lack of benefits, income instability, and the responsibility for self-employment tax.

- Advantages of being a W-2 employee include employer-provided benefits, simplified tax obligations, and income consistency.

- Disadvantages of being a W-2 employee include a lack of control over schedule and projects, limited income potential, and dependency on your employer.

- Is being a 1099 contractor or a W-2 employee better from a tax perspective? That depends on various factors, including your financial situation and how you manage your work expenses.

1099 vs. W-2

Forms 1099 and W-2 are both tax forms that companies give to different types of workers, and that determine how workers are classified for tax purposes. Whether you’re classified as a 1099 independent contractor or a W-2 employee, it can significantly impact your finances, benefits, and work-life balance. Understanding the differences between the two can help you decide which option might be better for your work situation.

1099: Independent contractor

Form 1099 is used to report income earned by independent contractors. If you’re a freelancer, consultant, or gig worker, you’re likely to be classified as an independent contractor.

This means you’re essentially self-employed, running your own business, even if you’re working for another company. You have the flexibility to set your own hours and choose your projects, but you’re also responsible for handling your own taxes and benefits.

W-2: Employee

Form W-2 is for employees. If you receive a W-2, you’re considered an employee of a company. This means the company withholds taxes from your paycheck and handles your tax reporting to the IRS.

As an employee, you might also receive benefits such as health insurance, retirement plans, and paid leave. Your employer dictates your work hours and duties.

Keep in mind that it’s not always an either/or situation. If you work for multiple companies, you might be classified as an employee by one and an independent contractor by another.

Advantages of being paid as a 1099 contractor

Being paid as a 1099 contractor comes with several advantages that might appeal to those who value flexibility and independence.

Key advantages of being a 1099 contractor:

- Tax deductions: As an independent contractor, one of the best tax benefits available to you is the ability to deduct various business-related expenses from your taxable income and lower your tax. This includes office supplies, travel expenses, and even part of your home, if you have a qualifying home office.

- Flexibility and control: As a 1099 contractor, you have the freedom to set your own schedule and choose the projects you want to work on. This can be especially appealing if you prefer to work during specific hours or need a more adaptable work-life balance.

- Potential for higher earnings: As a contractor, you're not tied to a single employer. This means you can take on multiple projects from different clients. Taking on a second job or another client can potentially lead to higher earnings compared to a regular salary. Additionally, independent contractors often charge higher hourly rates to cover their own expenses and benefits.

- Diverse work experience: Working as a 1099 contractor allows you to gain experience in different industries and roles. This can help you build a diverse résumé and enhance your skills, making you more marketable to future clients or employers.

- Independence: Being your own boss means you get to make all the decisions about how you work. You’re not subject to the same level of oversight and management as traditional employees, which can be liberating for those who thrive on autonomy.

Disadvantages of being paid as a 1099 contractor

While there are many perks to being a 1099 contractor, there are also some significant drawbacks to consider.

Main disadvantages of being a 1099 contractor:

- Tax responsibilities: Independent contractors are responsible for paying their own taxes, including self-employment taxes. This requires you to keep more meticulous records and potentially pay quarterly tax to the IRS. Failing to manage your taxes properly can lead to penalties and interest charges, not to mention the shock of a huge tax surprise.

- Administrative burden: Running your own business involves a significant amount of administrative work. As a contractor, you’ll be responsible for handling invoicing, accounting, marketing, and client communications, which can take up a considerable amount of time that could otherwise be spent on billable work.

- Lack of benefits: As a 1099 contractor, you don’t receive employee benefits, like health insurance, retirement plans, paid vacation, or sick leave. This means you need to arrange and cover these things on your own, which can be costly and time consuming.

- Income instability: Unlike employees who receive a regular paycheck, 1099 contractors’ earnings can fluctuate from month to month depending on the availability of work and the timely payment from clients. This can make financial planning more challenging.

- Job insecurity: Independent contractors do not have the same job security as employees. Clients can terminate contracts with little notice, leaving you without income. Building a steady client base and maintaining good relationships are essential but can be uncertain.

Advantages of being paid as a W-2 employee

Being paid as a W-2 employee offers several benefits that can provide stability and peace of mind.

Key advantages of being a W-2 employee:

- Tax simplicity: As a W-2 employee, your employer handles most of your tax obligations. They withhold federal and state income taxes, Social Security, and Medicare taxes from your paycheck, making it simpler for you to manage your tax responsibilities. At the end of the year, you receive a W-2 form that details your earnings and tax withholdings, which you use to file your tax return.

- Employee benefits: One of the most significant perks of being a W-2 employee is the access to benefits provided by your employer. These benefits often include health insurance, retirement plans like a 401(k), paid vacation, sick leave, and sometimes even bonuses. These can add significant value to your overall compensation package.

- Job security: W-2 employees typically enjoy greater job security compared to independent contractors. Employers are often more committed to their employees, providing more stable and predictable employment. Additionally, labor laws offer various protections to employees that contractors do not have, such as minimum wage laws and overtime pay.

- Consistent income: As a W-2 employee, you receive a regular paycheck, which makes budgeting and financial planning easier. This consistent income stream can help you manage your expenses more effectively and provide a sense of financial stability.

- Professional development opportunities: Many employers offer training and development programs to help employees advance their careers. This can include access to courses, certifications, and other resources that can enhance your skills and make you more valuable in the job market.

Disadvantages of being paid as a W-2 employee

While there are many benefits to being a W-2 employee, there are also some downsides that might make this type of employment less appealing to some.

Main disadvantages of being a W-2 employee:

- Fewer tax deductions: Employees have fewer opportunities to deduct expenses on their tax returns. While independent contractors can deduct business-related expenses, employees can only claim a limited number of deductions, which might not offset their work-related costs.

- Less flexibility: As a W-2 employee, you usually have less control over your work schedule and the projects you take on. Employers set your work hours and assign tasks. This can limit your flexibility and autonomy.

- Limited income potential: W-2 employees often have a fixed salary or hourly wage, with infrequent promotions and salary increases. This can limit your earning potential, as opposed to contractors, who can take on multiple clients or projects to increase their income.

- Dependency on employer: Your financial stability and benefits are tied to your employer. If your employer faces financial difficulties or decides to downsize, you could lose your job and benefits. This dependency can be risky, especially if the job market is uncertain.

- Potential for office politics: Working as an employee often means navigating office politics and dealing with workplace dynamics that can be stressful. The need to align with company culture and manage relationships with colleagues and supervisors can sometimes be challenging.

For tax purposes, is it better to get paid 1099 or W-2?

When it comes to taxes, the decision between being paid as a 1099 contractor or a W-2 employee depends on various factors, including your financial situation and how you manage your work expenses.

As a 1099 contractor, you’re considered self-employed. This means you’re responsible for paying both the employer and employee portions of Social Security and Medicare taxes, commonly referred to as self-employment taxes. On the plus side, you can deduct a wide range of business expenses from your taxable income, from home office expenses to travel. These deductions can significantly reduce your tax.

As a W-2 employee, your taxes are withheld by your employer. This includes federal and state income taxes, Social Security and Medicare taxes. Your employer also contributes to Social Security and Medicare taxes on your behalf, and you’re only responsible for paying the employee portion. While you have fewer opportunities to claim deductions, your tax obligations are generally simpler and more predictable.

So which option is better? There’s no one-size-fits-all answer. If you’re disciplined about managing your business expenses and can take advantage of significant deductions, being a 1099 contractor might be more tax efficient. However, if you prefer simplicity and predictability, and don’t want the hassle of handling your own taxes and payments, being a W-2 employee could be the better choice.

Ultimately, you should not just consider tax implications while deciding which option is better. Make sure that you also consider other factors, like job security, benefits, and work-life balance.

Do 1099 contractors pay more taxes?

Whether you’ll pay more taxes as a 1099 contractor or a W-2 employee depends on your ability to effectively manage and deduct business expenses.

Here’s what you need to know

- Self-employment tax: 1099 contractors are subject to self-employment tax, which covers both the employer and employee portions of Social Security and Medicare taxes. This totals 15.3% of your net earnings. In contrast, W-2 employees only pay the employee portion (7.65%), while their employer covers the remaining half.

- Income tax rates: Both 1099 contractors and W-2 employees are subject to federal and state income taxes based on their earnings. However, 1099 contractors can reduce their taxable income through business expense deductions, which can lower their overall tax liability.

- Deductions and write-offs: One of the significant advantages for 1099 contractors is the ability to deduct business-related expenses, which can substantially reduce taxable income, and potentially lower your overall tax. These deductions can include home office expenses, health insurance premiums, travel expenses, and equipment.

- Tax withholding and payments: W-2 employees have taxes automatically withheld from their paychecks, making it easier to manage and ensuring they don’t owe large amounts at tax time. 1099 contractors must make estimated quarterly tax payments to cover their income and self-employment taxes. This requires careful planning and saving to avoid penalties and interest for underpayment.

While 1099 contractors face higher self-employment taxes, the ability to deduct business expenses can offset these costs. In some cases, this can lead to a lower overall tax burden compared to W-2 employees. However, the complexity of tax filings and the need to manage quarterly payments can make it more challenging.

Whether you’re a 1099 contractor, a W-2 employee, or both, you don’t have to file alone. Work with a Jackson Hewitt Tax Pro to get every credit, deduction, and dollar you deserve.

Best of all, we’re open all year, so you don’t have to wait until tax season to work with an expert. Schedule an appointment today to create a tax plan that will work for your unique situation.

Read more articles from Jackson Hewitt

Get a Tax Pro

Our Tax Pros are ready to help you year-round. Find an office near you!

Still need tax help?

We’re here for you! Find a nearby location today.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.